Love it or Hate it, but if you have even the slightest of the interest in the tech industry, the you just can’t ignore TikTok. And recently, the only big news in the tech industry that everybody is keenly following is the potential acquisition (in part or global) of TikTok. Microsoft is the frontrunner right now in the list of buyers with some reports suggesting the potential deal size to be as high as $50 billion. But, is TikTok really worth $50 billion? Or does it even make sense for anyone to acquire TikTok in the first place? Let’s try to figure out.

Background

TikTok, the short video sharing platform took the world by storm and gained 800M+ active users in just under 4 years. However, being a Chinese company (TikTok is owned by China’s ByteDance), TikTok has time and again found itself at crossroad with governments all over the world. This time, due to the forever ongoing concerns about Data Privacy with the Chinese apps, TikTok has once again landed into trouble – specifically with India and the US.

- India, in the wake of increasing border tensions with China, has already banned TikTok along with some other popular Chinese apps.

- US has not yet banned TikTok but has given a 90 day deadline to divest all it’s US operations.

Given all this background, 2 major things have happened recently –

- TikTok clones (both new and old) are gaining popularity and going full throttle in terms of product development and influencer onboarding to capture the market share forcibly snatched from Tiktok. Even Instagram wants a piece of the pie and recently launched it’s own version of TikTok named Instagram Reels.

- ByteDance, for the first time, is seriously considering selling off TikTok. Some of the biggest names in the tech space are in the run for acquiring TikTok –

- Microsoft – estimated $50bn deal for US, Canada, Australia, NewZealand business

- Twitter – potential deal for the US business

- Reliance – estimated $5bn deal for India business

With all these big valuation numbers being thrown around, it makes you wonder what exactly are TikTok’s assets for which these companies are willing to shell out such insane amount of money?

TikTok’s Assets

- User Base

- Influencers

These are the celebrities of TikTok, the “TikTokers” with millions of followers. They set the trends and people just blindly follow them. Some of them are no less than rockstars in terms of the fan following. - Rest of the Users

All the users except influencers

- Influencers

- Recommendation Engine

The algorithm that powers the famous “For You” section. - Rest of the Technology

All the technology outside of recommendation engine. - User Historical Data

The rich history of user behaviour data going to the very granular levels of each click, impression, watch time etc.. and other user sensitive data. - Huge library of User Generated Content (UGC)

The billions of TikTok Videos uploaded by users over the last 4 years.

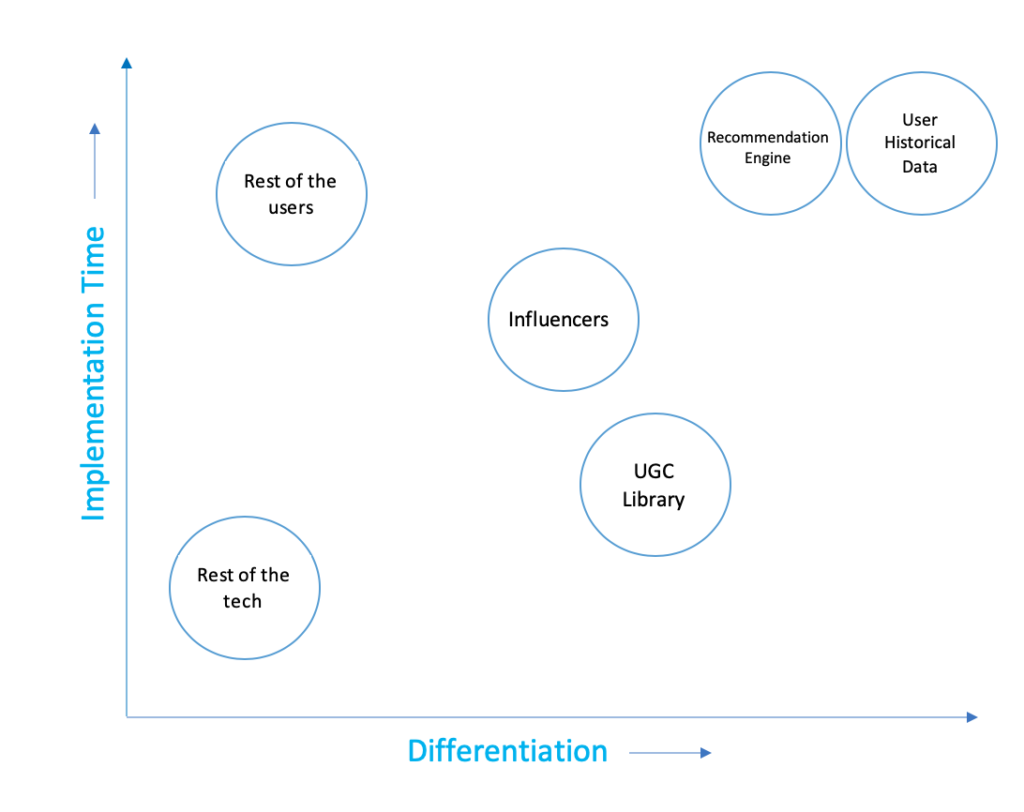

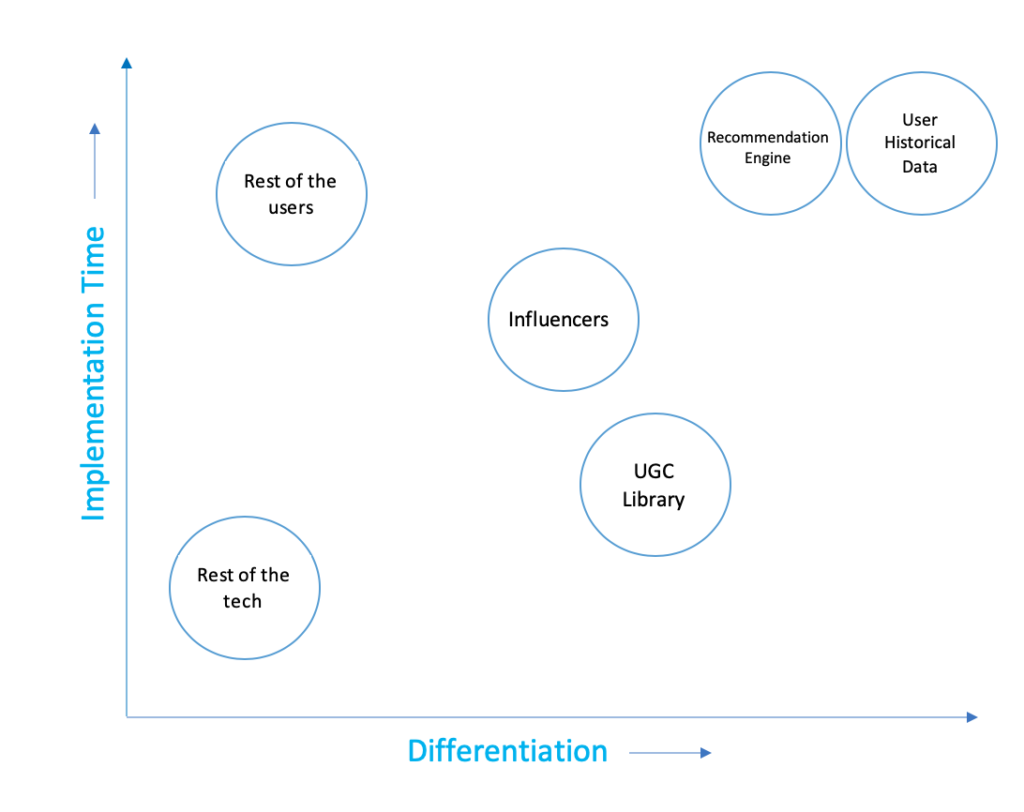

Now, let’s just try to evaluate these assets on the basis of –

- Differentiation

How unique is a specific asset to TikTok? Can competition replicate it? The more complex the asset the more differentiating it will be. - Implementation Time

How long does it take to develop that asset in-house?

- User base

- Influencers

Onboarding them is a race because many influencers have exclusive contracts with one or the other platform. The quickly you onboard the influencers the bigger is your user base. - Rest of the users

Though this is a metric that many platforms boast of, but this is not really a differentiator in this context. The network effect from influencers will organically drive this metric. Most of the clone apps have been able to quickly acquire tens of millions of users. But even with all that, it would take a good amount of time for a new platform to reach TikTok levels.

- Influencers

- Recommendation Engine

The recommendation engine is the real deal. Analysing billions of short videos and identifying recommendations tailored for each of the 800 million users is a Herculean task. And TikTok has been killing it. This is probably one of “the” biggest reasons why TikTok is so successful despite having clones since the very beginning. - Rest of the technology

Nothing complex here to act as a differentiator. Most of the clone apps came up with all the TikTok like features in less than a week after ban. - User Historical Data

Data is indeed the new oil. This is the fuel that powers the recommendation engine. However, irrespective of the quality of algorithm, this is something that takes time to build and TikTok has been building on it for years. - Huge library of User Generated Content

This is something that definitely helps and having a variety of the content across genres keep the users engaged and eventually grow the user base in long run. However, the problem with UGC is that it is highly prone to copy/piracy. All you need is a simple crawler script to download the videos from one platform and upload it on another platform. Most of the recent clones have been doing exactly this. By the time, the original creator will get to know about it or will take any legal action to get the content removed, it would have been already milked on the clone platform.

Going by the above analysis, the only real asset that anyone gets by acquiring TikTok is primarily the Recommendation engine and the user historical data. But is that something worth tens of billions of dollars? In my opinion, a big NO. Because –

- The rich historical data that we are talking about may not even be part of the deal. This data is in fact, in a way, the core of all these problems. TikTok went a little too far and has acquired a lot more data than it should have and is probably sharing it with China as well. However, TikTok has not yet acknowledged either collecting such user sensitive data or sharing it with China. It wouldn’t be a surprise if all such data is quietly deleted or migrated to some other server location and is never made part of the acquisition deal.

- With respect to the “Recommendation engine”, this isn’t something new to the the core tech companies like Microsoft and Twitter. They have been already dealing with data even much bigger than TikTok’s. Microsoft has it’s own search engine, Bing and Twitter is apparently handling 200 billion tweets per year already. It may actually not be very difficult for them to do it again with TikTok’s data. Moreover, as the saying goes “Reading code is much harder than writing it”, investing in building the recommendation engine in-house would give them much better control and flexibility in the long run.

- Another hypothesis (with no data support) is that TikTok users are usually not really looking for high quality content (let’s keep the TikTok vs YouTube debate for some other time) and are just highly addicted to endlessly watching the goofy no brainer videos back to back. They may just enjoy anything and everything that is thrown their way. A super intelligent recommendation engine is probably not what they deserve.

Buyers should try to look past the hype driven by the excessive media attention and should not make this decision just in haste.